Our approach to tax

Business rationale

Kemira’s approach to tax matters is to support responsible business performance in a sustainable way. Kemira manages taxes according to the principles set in Kemira´s global tax policy (“Tax Policy”). In order to support sustainable business operations with high ethical corporate responsibilities, Tax Policy is aligned with our corporate strategy and values as well as the Kemira Code of Conduct. We are committed to conduct our business in compliance with all applicable laws and regulations and according to high ethical standards. We are a responsible corporate citizen in all our operating countries.

Transparency and relationship with tax authorities

We are transparent and proactive in all interactions with the tax authorities. We have an open and positive working relationship with the tax authorities and we aim at constructive dialogue with them. Kemira is committed to promptly and transparently disclose all tax matters with the tax authorities.

Compliance

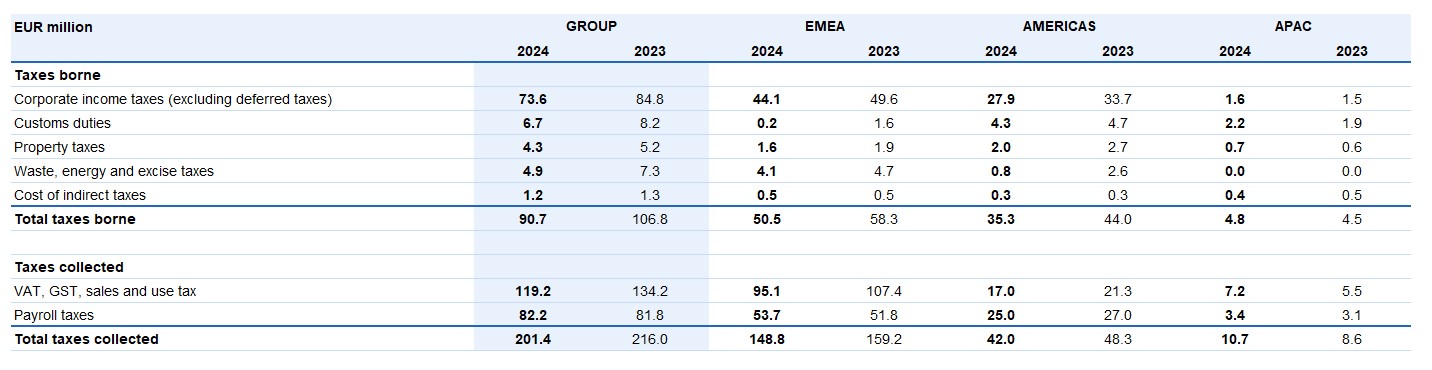

We are committed to meet all statutory compliance obligations in each jurisdiction. We comply with the applicable tax rules in our operating countries for all tax filing, reporting and payment obligations. Kemira monitors closely legislative changes and developments globally such as OECD Pillar 2 -requirements as well as tax interpretations made by the local tax authorities. In addition to corporate income taxes, Kemira pays or collects other taxes, for example, indirect taxes, property taxes, customs duties, energy, waste and plastic taxes, employment taxes like payroll taxes and social security contributions.

Transfer pricing

We apply the OECD standards in cross-border transactions and we ensure that our transfer pricing is in accordance with the “arm’s length principle”. Kemira has implemented the automated transfer pricing processes with aid of Operational Transfer Pricing Analytics solution. Kemira has centralized business models, one single ERP system and robotics to manage these processes. Kemira also meets the transfer pricing and Country-by-Country (“CbC”) reporting requirements in each jurisdiction as required.

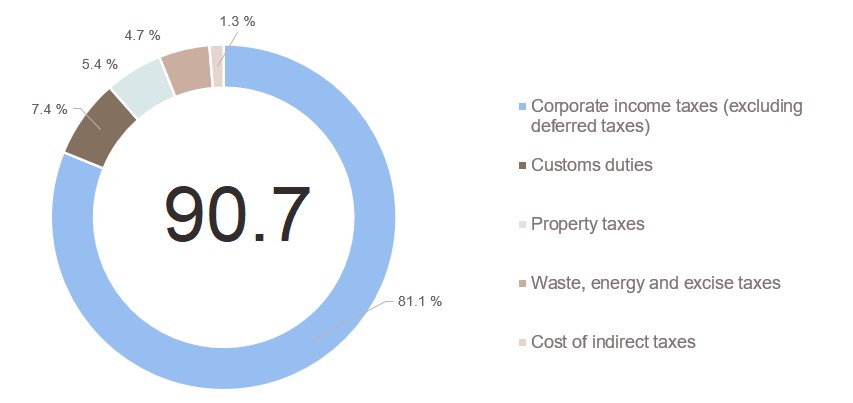

Kemira’s global Tax Footprint in 2024

Kemira publishes the eight Tax footprint report for the financial year 2024 in February 2025 – the first tax footprint report was published for the financial year 2017. In 2024, Kemira’s total tax contribution was EUR 292.1 million (322.8) of which EUR 90.7 million (106.8) related to taxes borne and EUR 201.4 million (216.0) to taxes collected. Total taxes in Finland were EUR 115.5 million (EUR 133.1).