What is Kemira’s vision and strategy?

Kemira is a global leader in sustainable chemical solutions for water-intensive industries – with roots over a hundred years ago. Our customers include large companies in the pulp and paper sector, as well as municipal and industrial water treatment companies. With our solutions, our customers can advance circularity and responsible resource stewardship in their value chains.

Sustainability transformation is driving the growth, and our aim is to double the revenue from the 2024 level in water in the long run. This is supported by the tightening regulation globally. In addition, by the end of 2030 over 500 million of our revenue is targeted to come from renewable solutions.

Our long-term financial goals are:

- Average annual organic growth over 4%

- Operative EBITDA margin of 18–21%

- Operative ROCE over 16%

Read more about Kemira’s strategy.

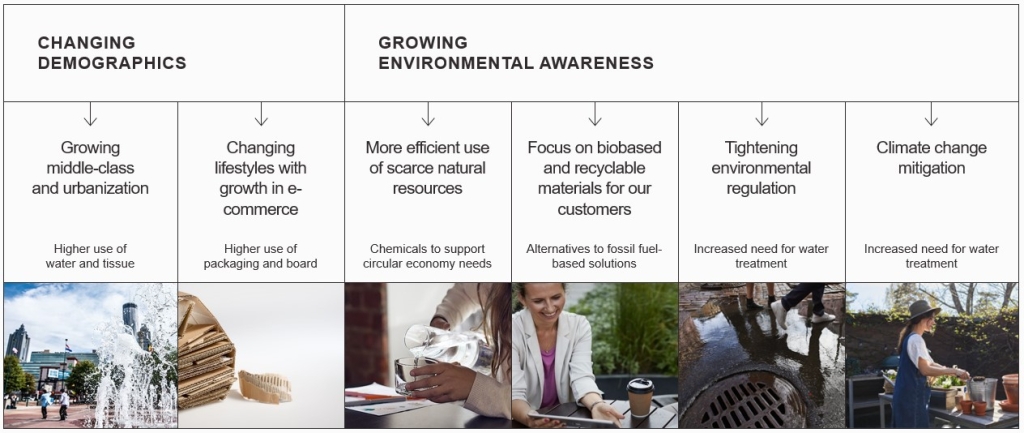

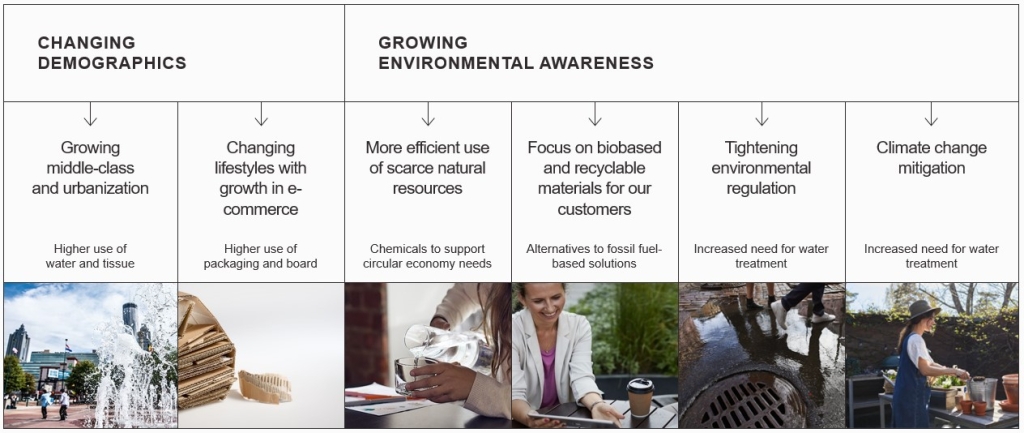

What drives growth in Kemira’s markets?

The two most important global megatrends driving growth of Kemira’s end markets are changing demographics and growing environmental awareness, which is further resulting in tightening regulation.

Changing demographics

A growing middle-class population, particularly in Asia-Pacific, is expected to result in higher use of water, which will ultimately drive the demand for water treatment chemicals. Changing lifestyles and growth in e-commerce, partly driven by higher income per capita, will lead to higher need for packaging solutions globally. This will further boost the demand for pulp and paper chemicals; Kemira’s core expertise.

Growing environmental awareness

The overall sustainability trend, including more efficient use of natural resources and higher need for recyclable products is expected to be beneficial for Kemira’s end-markets. Kemira’s solutions enable its customers to use resources, water included, more efficiently. One particular trend, the replacement of plastic packaging, is expected to drive growth of fiber-based packaging solutions. This in turn is expected to increase the demand for pulp and paper chemicals. In addition, the tightening regulation supports Kemira’s ambition to double its water treatment business.

Global megatrends largely favor Kemira – sustainability becoming a key driver for the long term

In which businesses does Kemira operate?

Kemira is a global leader in sustainable chemical solutions for water-intensive industries. We provide the best suited products and expertise to improve our customers’ product quality, process and resource efficiency. We have three business units: Water Solution, Packaging & Hygiene Solutions and Fiber Essentials

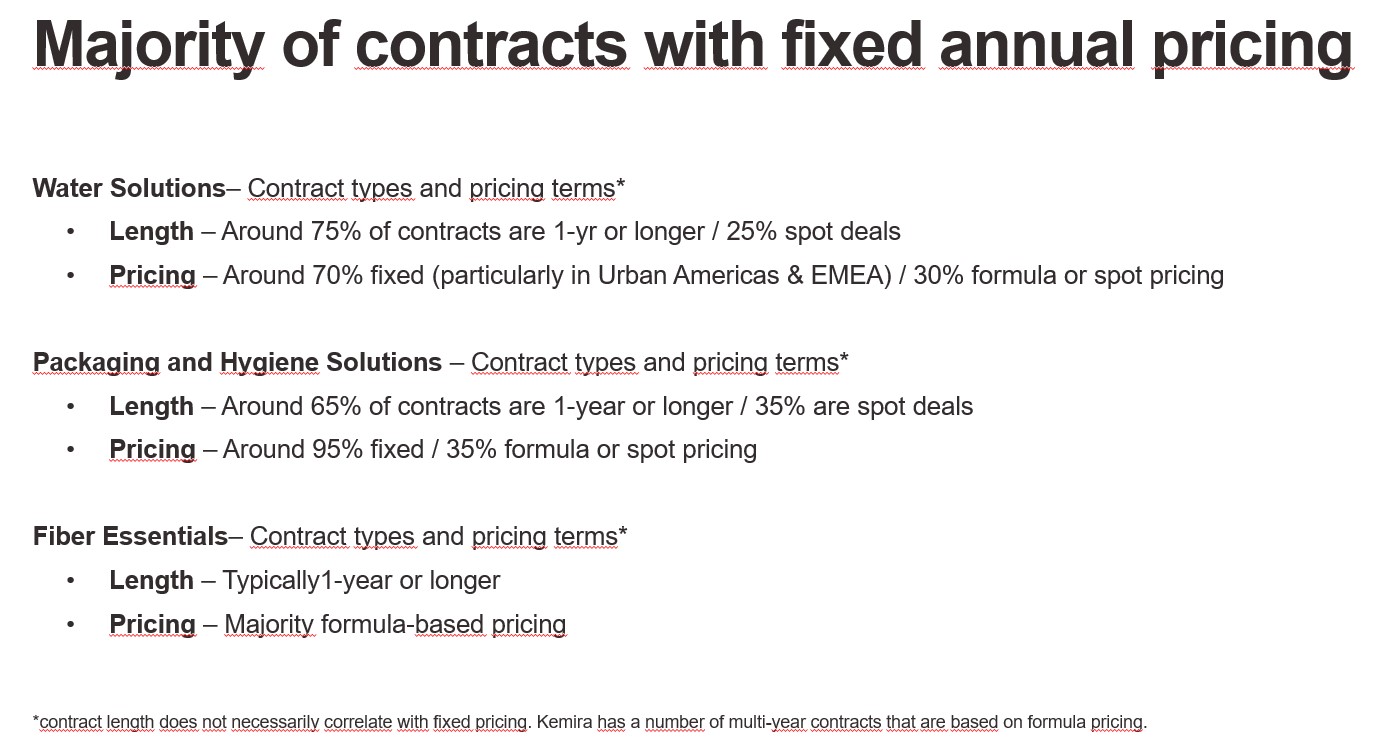

Water Solutions

- Provides water treatment solutions for both municipal and industrial water treatment facilities

- ~45% of total sales

- Strong focus on growth and cash flow

Packaging & Hygiene Solutions

- Focuses on the growing renewable solutions market, particularly packaging

- ~35% of total sales

- Attractive, potential new growth markets: molded fibers, textile fibers, renewable chemistry solutions & digital services

Fiber Essentials

- Provides critical chemicals for the pulp and bleaching market

- ~20% of total sales

- Sodium Chlorate the largest business; market growing particularly in South America

Where does Kemira want to grow?

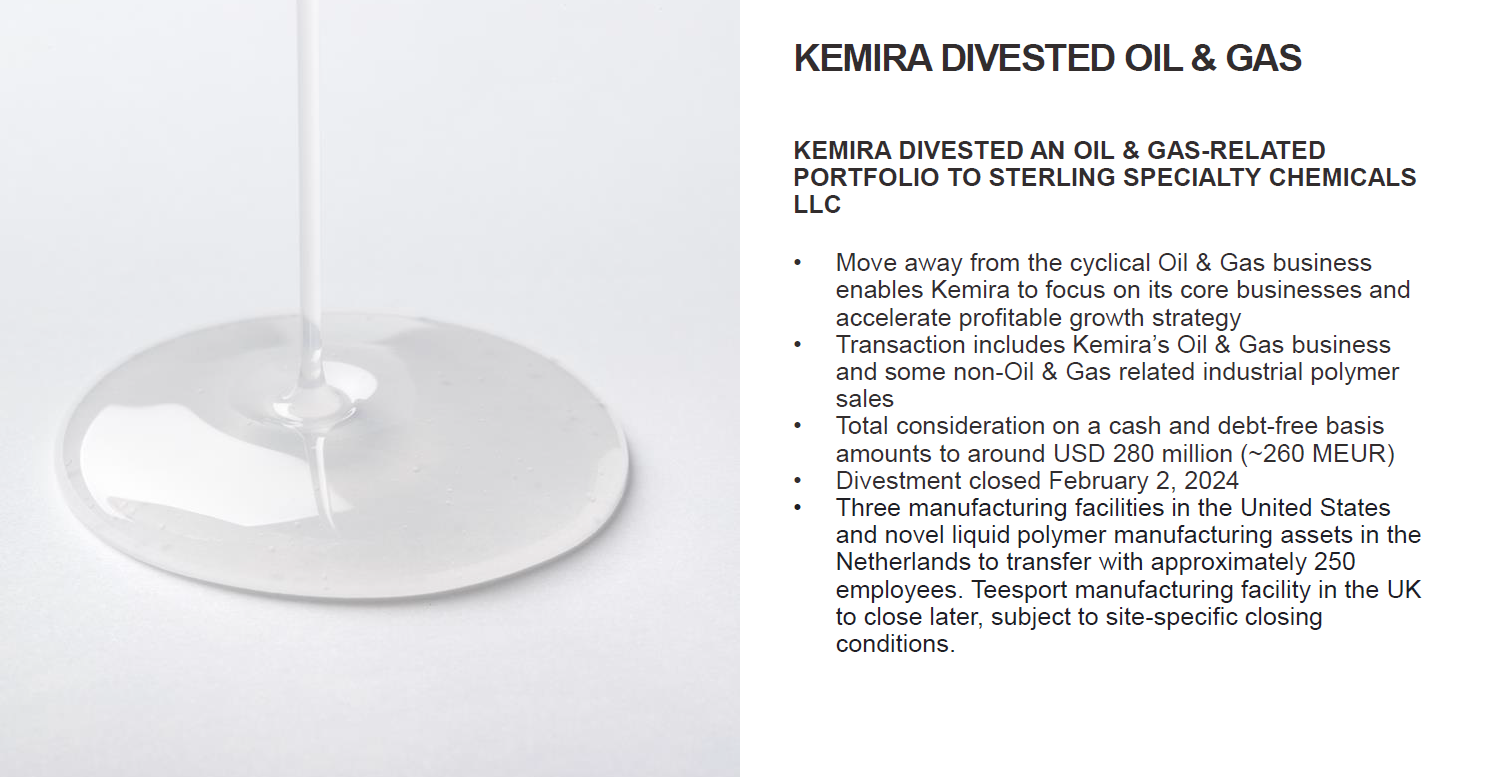

Water and renewable solutions are at the heart of the new Kemira. Water is expected to be the key contributor for revenue growth going forward. Kemira announced in September 2024 that its new long-term ambition is to double the revenue in water. This includes both organic and inorganic growth possibilities.

Firstly, possible acquisitions could be related to market consolidation in Kemira’s more mature markets in EMEA and North America, where Kemira already has a strong presence. Secondly, new technologies and competencies could be also be possible as these would complement Kemira’s current product offering of coagulants and polymers to its water treatment customers. Thirdly, Kemira could also look at possible acquisition targets in the APAC market to strengthen its presence there. Currently Kemira has only a small presence in the growing APAC water treatment market.

Read more about the growth drivers here.

Where does Kemira operate and what are the most important countries by sales?

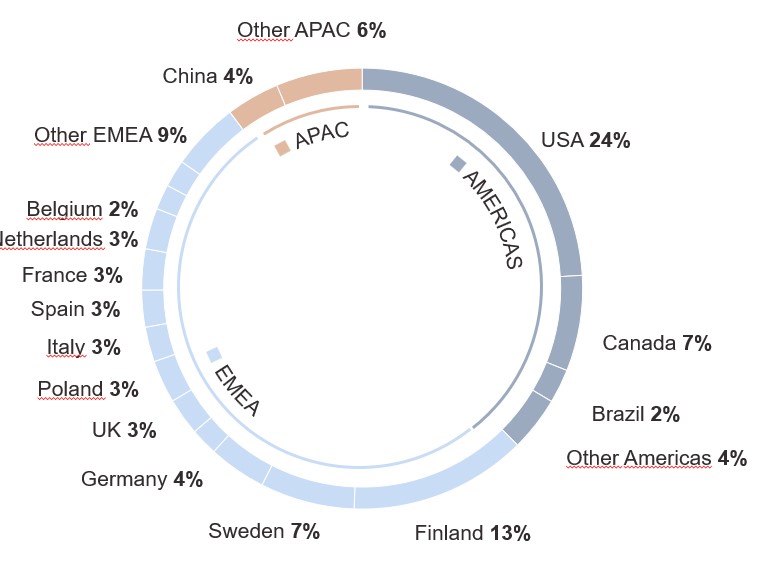

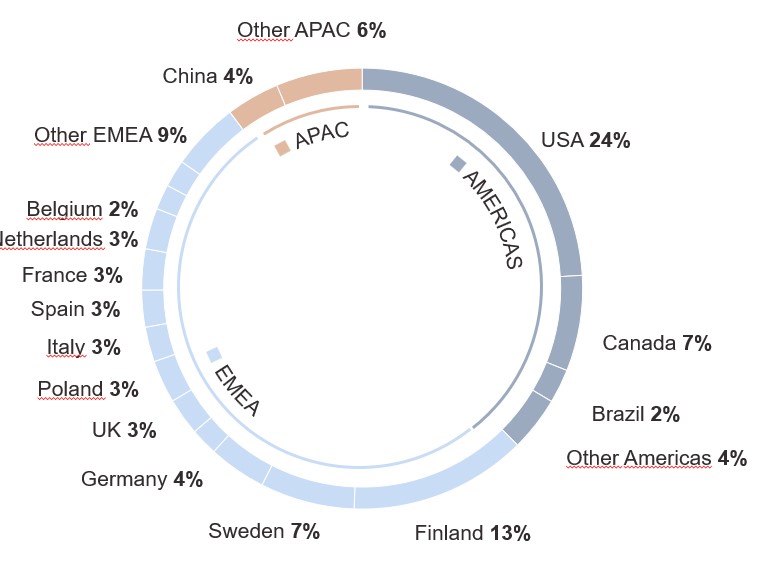

The US is the largest country in terms of sales and it accounted for 24% of revenue in 2024. Finland, the second largest country by sales, accounted for 13%.

Revenue split by country in 2024 (excluding the divested Oil & Gas business)

Is Kemira’s business seasonal or cyclical?

Overall, Kemira has a very resilient business model, which is not very prone to economic cycles. Kemira produces consumable chemicals that are used in customers’ processes, such as wastewater treatment or at pulp and paper mills.