Growth strategy

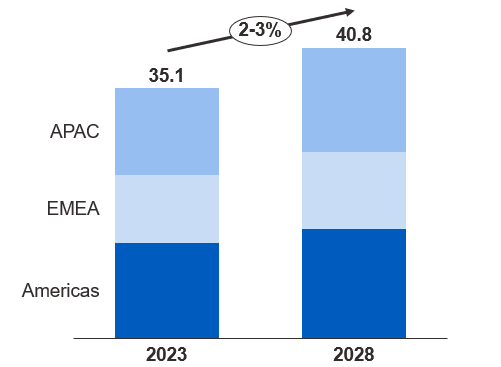

Targeting above-the-market revenue growth (market growth estimate 2023-2028, CAGR: ~2-3%):

| Megatrend | Impact | How Kemira benefits from the megatrend, for example |

| CHANGING DEMOGRAPHICS | Growing middle-class and urbanization | Higher use of water and tissue |

| Changing lifestyles with growth in e-commerce | Higher use of packaging and board | |

| GROWING ENVIRONMENTAL AWARENESS |

More efficient use of scarce natural resources | Chemicals to support circular economy needs |

| Focus on renewable solutions and recyclable materials for our customers | Alternatives to fossil fuel based solutions | |

| Tightening environmental regulation | Increased need for water treatment | |

| Climate change mitigation | Increased need for water treatment |

Kemira provides expertise and tailored combinations of chemicals for water intensive industries. Kemira’s relevant market (EUR ~35 billion in 2023) estimated to grow to EUR 6 billion in 2028 (CAGR 2-3%).

KEMIRA RELEVANT MARKET

EUR billion

*CAGR, compound annual growth rate

Source: Management estimation based on various sources

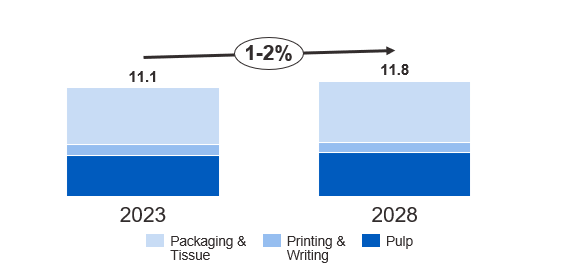

Pulp & Paper

Kemira’s Pulp & Paper segment has unique expertise in applying chemicals and supporting pulp & paper producers to innovate and constantly improve their operational efficiency.

Pulp & Paper market is expected to grow at 1-2% CAGR*

Relevant target market around EUR 12 billion.

*CAGR, compound annual growth rate

Demand drivers:

- Hardwood and softwood pulp demand increasing driven by growth of packaging needs (e-commerce, non-plastic solutions), growing tissue demand and lack of recycled fiber

- Demand increase continues for packaging, driven by online shopping, last-mile delivery, product safety and non-plastic solutions

- Growth in tissue demand driven by increasing wealth in emerging countries

- Ongoing digitalization of media drives decline of graphic paper demand

Water link:

-

Efficient utilization of water at the core of pulp and paper manufacturing.

-

Energy consumption, product quality, process runnability

and customers’ profitability depend on water efficiency.

Main competitors:

- e.g. Solenis, Nouryon, Ecolab, SNF, Chemtrade, Solvay

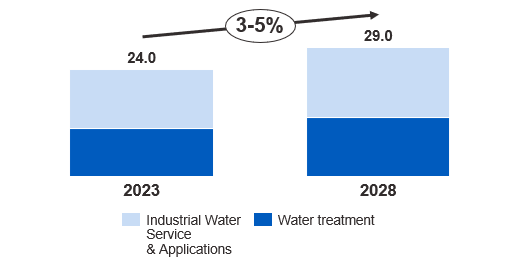

Industry & Water

Industry & Water supports municipalities and water intensive industries in the efficient and sustainable utilization of resources. In water treatment, we help in optimizing every stage of the water cycle.

Industry & Water market expected to grow at 3-5% CAGR*

Relevant target market around EUR 29 billion.

*CAGR, compound annual growth rate

Demand drivers:

- Higher demand for water driven by industrial growth and population growth

- More stringent discharge limits for waste water

- Better dewatering of sludge

- Phosphorus recovery

- Water reuse

Water link:

- Focus on environmental regulations (waste water and reuse).

- Increased total process efficiency requirements for water intensive processes.

- Applications reducing costs, minimizing water consumption and increasing yield.

Main competitors:

- Polymers: e.g. SNF, Solvay, Ecolab, Solenis

- Coagulants: mainly local companies e.g.; Feralco, USalco, Chemtrade